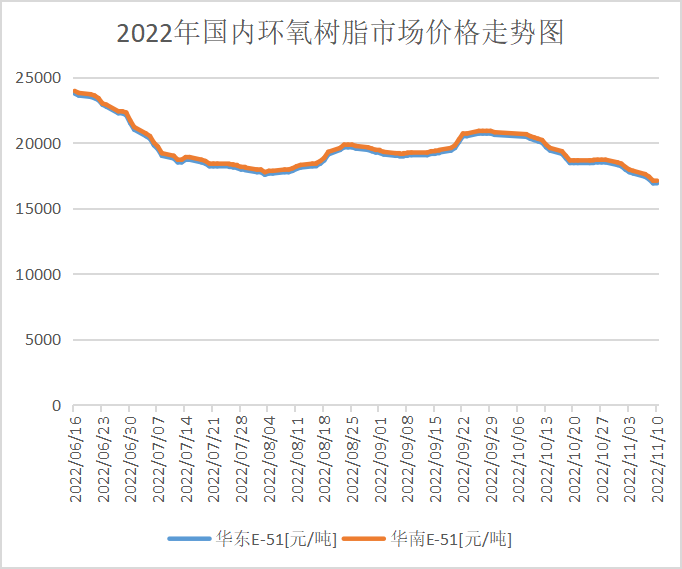

Bekeng e fetileng, 'maraka oa epoxy resin o ne o fokola,' me theko ea indasteri e ile ea theoha ka ho sa feleng, eo ka kakaretso e neng e le bearish. Bekeng, bisphenol A e tala e ne e sebetsa maemong a tlase, 'me thepa e' ngoe e tala, epichlorohydrin, e ne e theohela tlase ka mokhoa o moqotetsane. Kakaretso ea theko ea thepa e tala e fokolisitse tšehetso ea eona bakeng sa thepa e fumanehang. Lihlahisoa tse peli tse tala li ile tsa tsoela pele ho theoha ka tsela e fokolang, 'me tlhokahalo ea mmaraka oa resin ha ea ka ea ntlafala. Lintho tse ngata tse mpe li lebisitse ho se khoneng ho fumana lebaka le letle la theko ea epoxy resin. Litheko tsa mofuta oa bobeli le oa boraro oa LER 'marakeng li fanoe ka 15800 yuan/ton. Litheko tsa bahlahisi ba ka sehloohong ba tloaelehileng li theohile boemong bo tlaase ka ho fetisisa selemong sena, 'me ho ntse ho e-na le tebello ea ho fokotsa theko.

Bekeng e fetileng, fektheri e kholo ea Jiangsu e ile ea emisa bakeng sa tlhokomelo, 'me mojaro oa limela tse ling o ile oa fetoha hanyane. Kakaretso ea ho qala e fokotsehile ha e bapisoa le bekeng e fetileng. Har'a beke, tlhokahalo e tlaase ea noka e ne e fokola, 'me moea oa liodara tse ncha o ne o le bobebe. Ke ka Laboraro le fetileng feela, boemo ba ho botsa le ho tlatselletsa bo ile ba ntlafala hanyane, empa bo ne bo ntse bo laoloa ke ho tlatsoa ho hlokahalang feela. Khatello ea bahlahisi ba resin ea ho romelloa ka sekepe e phahame, 'me lifeme tse ling li utloile hore thepa e phahame hanyenyane. Ho na le moeli o mongata tlhahisong, 'me sepheo sa khoebo ea mmaraka se tlase.

Bisphenol A: Bekeng e fetileng, tekanyo ea tšebeliso ea matla a limela tsa malapeng a bisphenol A e ne e le 62.27%, e theohile ka liphesente tse 6.57 ho tloha ka November 3. Bekeng ena ea South Asia ea ho koaloa ha polasetiki le tlhokomelo, Nantong Star Bisphenol A Plant e reretsoe ho koaloa bakeng sa tlhokomelo bakeng sa beke e le 'ngoe ka la 7 November, le Changchun e reriloeng bakeng sa lisebelisoa tse peli tsa lik'hemik'hale tse tla koaloa pele. ho koaloa ka lebaka la ho hloleha ka la 6 Pulungoana, e lebelletsoeng ho ba beke e le 'ngoe). Huizhou Zhongxin e koetsoe ka nakoana ka matsatsi a 3-4, 'me ha ho na phetoho e totobetseng mojaro oa likarolo tse ling. Ka hona, sekhahla sa tšebeliso ea matla a semela sa lapeng sa bisphenol A se ea fokotseha.

Epichlorohydrin: Bekeng e fetileng, sekhahla sa tšebeliso ea matla indastering ea lehae ea epichlorohydrin e ne e le 61.58%, ho fihla ho 1.98%. Bekeng, Dongying Liancheng 30000 t/a propylene plant e ile ea koaloa ka October 26. Hona joale, chloropropene ke sehlahisoa se seholo, 'me epichlorohydrin ha e e-s'o tsosolosoe,' me e ntse e tsoela pele; Tlhahiso ea letsatsi le letsatsi ea epichlorohydrin ea Binhua Group e eketsehile ho lithane tse 125 ho leka-lekanya hydrogen chloride e holimo; Ningbo Zhenyang 40000 t / a glycerol process plant e ile ea tsosolosoa ka la 2 November, 'me tlhahiso ea letsatsi le letsatsi e ka bang lithane tse 100; Dongying Hebang, Hebei Jiaao le Hebei Zhuotai ba ntse ba le sebakeng sa ho paka, 'me nako ea ho qala bocha e ntse e latela; Ts'ebetso ea likhoebo tse ling e na le phetoho e nyane.

Polelo ea maraka ea ka moso

Phetoho ea 'maraka ea Bisphenol e ile ea eketseha hanyenyane mafelong a beke, 'me lifeme tse tlaase li ne li le hlokolosi ho kena' marakeng. Bahlahlobisisi ba 'maraka ba lumela hore: maikutlo a bareki le barekisi a tla tsoelapele ho bapala lipapali bekeng e tlang, ka liphetoho tse fokolang linthong tsa motheo tsa nako e khutšoanyane. Litebello tse fokolang tse tlisoang ke sesebelisoa se secha li tla hatella maikutlo a 'maraka,' me 'maraka o lebeletsoe ho fetola ho potoloha moeli oa litšenyehelo.

Cyclic chloride e ile ea tsoela pele ho hlaha. Palo e phahameng ea sechaba le menyenyetsi ea hore likarolo tse peli tsa North South li tla kenngoa tlhahiso khoeling e tlang li entse hore batho ba 'maraka ba be hlokolosi 'me boemo ba ho leta le ho bona' marakeng bo lula bo sa fetoha. Ho ea ka tlhahlobo ea batho ba ka hare, le hoja 'maraka oa hona joale o tsitsitse ka nakoana, ho ka etsahala hore' maraka oa nakong e tlang o tsoele pele ho theoha.

Phepelo ea 'maraka ea LER ha e na feela tlhahiso e ntseng e eketseha ea lisebelisoa tsa tlhokomelo, empa hape e na le matla a macha a kenang' marakeng. Ho utloisisoa hore semela sa epoxy se Wuzhong, Zhejiang (Shanghai Yuanbang No.2 Factory) se kentsoe tekong ka katleho matsatsing a 'maloa a fetileng. Ka mor'a sehlopha sa bobeli, 'mala oa sehlahisoa o fihlile hoo e ka bang 15 #. Haeba e tsoela pele ho lula e tsitsitse nakong e tlang, sehlahisoa se ke ke sa kena 'marakeng nako e telele. LER e tla tsoelapele ho khutlisa mohala o fokolang, ka tlhoko e kholo ea theko e thata, 'me ho thata ho bona matšoao a ho hlaphoheloa ka nako e khuts'oane.

Nako ea poso: Nov-14-2022