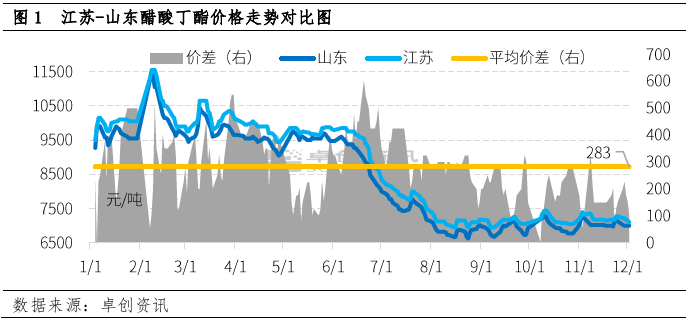

Ka December, 'maraka oa butyl acetate o ne o tataisoa ke litšenyehelo. Mokhoa oa theko ea butyl acetate Jiangsu le Shandong o ne o fapane, 'me phapang ea theko pakeng tsa tse peli e fokotsehile haholo. Ka la 2 December, phapang ea theko pakeng tsa tse peli e ne e le 100 yuan/ton feela. Ka nako e khutšoanyane, tlas'a tataiso ea lintho tsa motheo le lintlha tse ling, ho lebeletsoe hore phapang ea theko pakeng tsa tse peli e ka khutlela sebakeng se utloahalang.

E le e 'ngoe ea libaka tse ka sehloohong tsa tlhahiso ea butyl acetate Chaena, Shandong e na le phallo e pharaletseng ea thepa. Ntle le ts'ebeliso ea lehae, 30% - 40% ea tlhahiso e boetse e phallela Jiangsu. Karolelano ea phapang lipakeng tsa Jiangsu le Shandong ka 2022 e tla boloka sebaka sa arbitrage sa 200-300 yuan/ton.

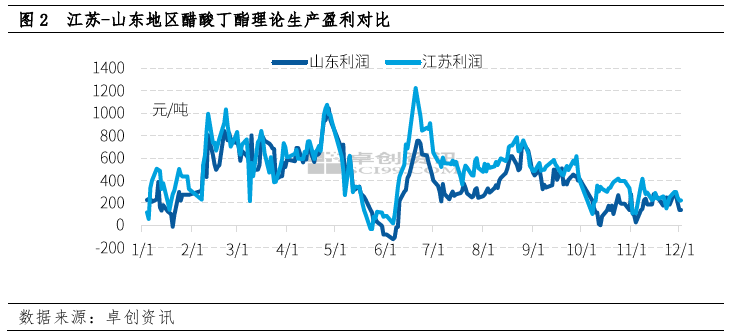

Ho tloha ka Mphalane, phaello ea tlhahiso ea theory ea butyl acetate e Shandong le Jiangsu ha e e-so fete 400 yuan/ton, eo Shandong e batlang e le tlase. Ka Tšitoe, phaello e akaretsang ea tlhahiso ea butyl acetate e fokotsehile, ho kenyeletsoa li-yuan tse ka bang 220/ton ho la Jiangsu le 150 yuan/ton ho la Shandong.

Phapang ea phaello e bakoa haholo ke phapang ea theko ea n-butanol ka theko ea libaka tse peli. Tlhahiso ea tone e le 'ngoe ea butyl acetate e hloka lithane tse 0.52 tsa acetic acid le lithane tse 0,64 tsa n-butanol,' me theko ea n-butanol e phahame haholo ho feta ea acetic acid, kahoo n-butanol e na le karolo e kholo ea theko ea tlhahiso ea butyl acetate.

Joalo ka butyl acetate, phapang ea theko ea n-butanol lipakeng tsa Jiangsu le Shandong esale e tsitsitse ka nako e telele. Lilemong tsa morao tjena, ka lebaka la ho feto-fetoha ha limela tse ling tsa n-butanol Profinseng ea Shandong le lintlha tse ling, lihlahisoa tsa limela sebakeng sena li ntse li le tlaase 'me theko e holimo, e leng se etsang hore phaello ea tlhahiso ea butyl acetate Profinseng ea Shandong e be tlase, le boikemisetso ba bahlahisi ba ka sehloohong ba ho tsoela pele ho etsa phaello le ho romela thepa e tlaase,' me theko e tlaase haholo.

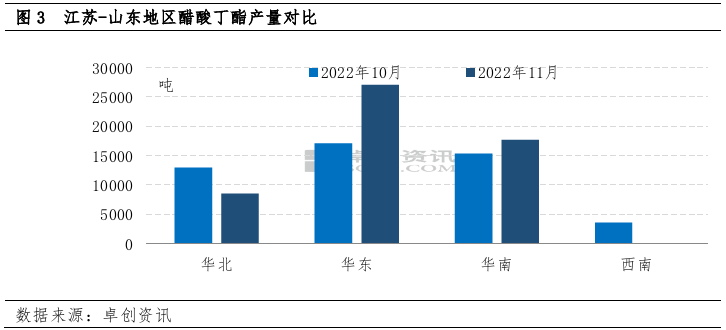

Ka lebaka la phapang ea phaello, tlhahiso ea Shandong le Jiangsu le eona e fapane. Ka November, kakaretso ea tlhahiso ea butyl acetate e ne e le lithane tse 53300, keketseho ea 8.6% khoeli le khoeli le 16.1% selemo le selemo.

Chaena Leboea, tlhahiso e ile ea fokotseha haholo ka lebaka la lithibelo tsa litšenyehelo. Kakaretso ea khoeli le khoeli e ne e ka ba lithane tse 8500, ho theoha ka 34% khoeli le khoeli,

Sephetho sa China Bochabela se ne se ka ba lithane tse 27000, ho nyoloha ka 58% khoeli le khoeli.

Ho ipapisitsoe le lekhalo le totobetseng lehlakoreng la phepelo, cheseho ea lifeme tse peli bakeng sa thomello le eona ha e lumellane.

Nakong ea morao-rao, phetoho e akaretsang ea n-butanol ha e bohlokoa tlas'a semelo sa thepa e tlaase, theko ea acetic acid e ka 'na ea tsoela pele ho theoha, khatello ea theko ea butyl acetate e ka' na ea fokotseha butle-butle, 'me phepelo ea Shandong e lebelletsoe ho eketseha. Jiangsu e lebelletsoe ho fokotsa phepelo ea eona ka lebaka la mojaro o phahameng oa kaho qalong le tšilo ea lijo e kholo haufinyane. Tlas'a semelo se ka holimo, ho lebeletsoe hore phapang ea theko pakeng tsa libaka tse peli e tla khutlela butle-butle boemong bo tloaelehileng.

Nako ea poso: Dec-06-2022